GUARANTEED AUTO PROTECTION PLUS (hereafter referred to as GAPP) is designed to protect both borrower and lender in the event a total loss occurs to the insured vehicle and there is a balance remaining after other insurance has, or would have, settled on the Actual Cash Value. The total loss is usually due to theft or severe physical damage. Either way, your customer has a real problem.

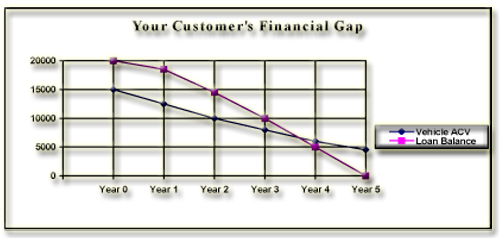

With the cost of today’s automobiles going higher and higher, many people are financing for longer terms, or are leasing their vehicles. This has created a scenario, in many cases, where the borrower owes more on the vehicle, than it is worth, for a substantial amount of time. In the event your borrower suffers a loss during this period, even if they have primary insurance, they could still owe you a large amount of money. GAPP makes sure the borrower’s remaining balance is satisfied, up to the limit of protection you choose to offer.

You can make this important protection available to each borrower in the form of a “Loan / Lease GAPP Waiver Addendum – Election Form” and finance the cost, along with the normal proceeds, over the life of the loan / lease.

The graph on page (1) is a good indication of just how “Upside Down” your borrowers may be in the first years of their loan and statistics show that nearly one third (1/3) of us will sustain a total loss, at some point in time. GAPP is the answer.

As the lender, your potential loss, from offering the “GAPP Waiver Addendum”, is backed by an insurance contract, between you and the underwriter. When, and if, you are called on to honor the waiver, you simply file your claim, for the unpaid balance you are owed, with your insurance company.

The benefits of this program are many, and the following are some examples for your consideration:

FOR THE LENDER GAPP WILL:

1. Make your customer aware that their primary insurance may not cover their entire debt.

2. Help you avoid losses, where primary or other insurance does not completely cover the principal balance.

3. Promote good will, between borrower and lender, should a covered loss occur.

4. Create repeat customers, if a covered loss occurs, as they most likely will finance their next purchase with you.

5. Be an additional source of fee income.

6. Require no licensing since the insurance coverage is between the lender and the underwriting company.

FOR THE BORROWER GAPP WILL:

1. Cover the deficiency balance of the principal, in the event of a total loss.

2. Prevent the borrower from defaulting on his obligation, to the lender.

3. Enable the borrower to negotiate a new loan or lease, without having to finance his previous financial gap.

4. Pay up to $1,000 toward a primary insurance deductible, in the event of a covered loss.

5. Help preserve the borrower’s credit rating, by retiring the debt.

6. Allow the borrower to continue the relationship with the lender.